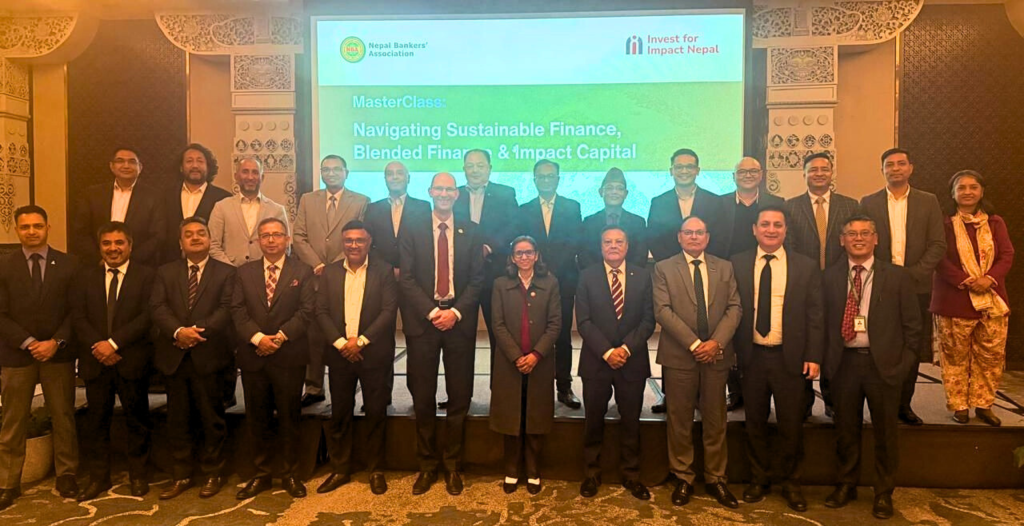

Nepal Bankers’ Association (NBA), in partnership with Invest for Impact Nepal (IIN), organized a Masterclass titled “Navigating Sustainable Finance, Blended Finance & Impact Capital,” for the leaders of Nepal’s banking sector. The session brought together Chief Executive Officers and Deputy Chief Executive Officers of Commercial Banks and National-level Development Banks. The program aimed to move

Masterclass on Sustainable Finance