Nepal Bankers’ Association (NBA), in partnership with International Finance Corporation (IFC) and Financial Literacy Nepal (FLN) held a capacity building session in Bhairahawa on Digital Financial Services, Current Issues and Financial Literacy. The program aimed to deepen participants’ understanding of Nepal’s evolving digital financial services sector, the pressing challenges faced by the banks and the issues related to the capital markets, and the critical role financial literacy plays in addressing these issues effectively.

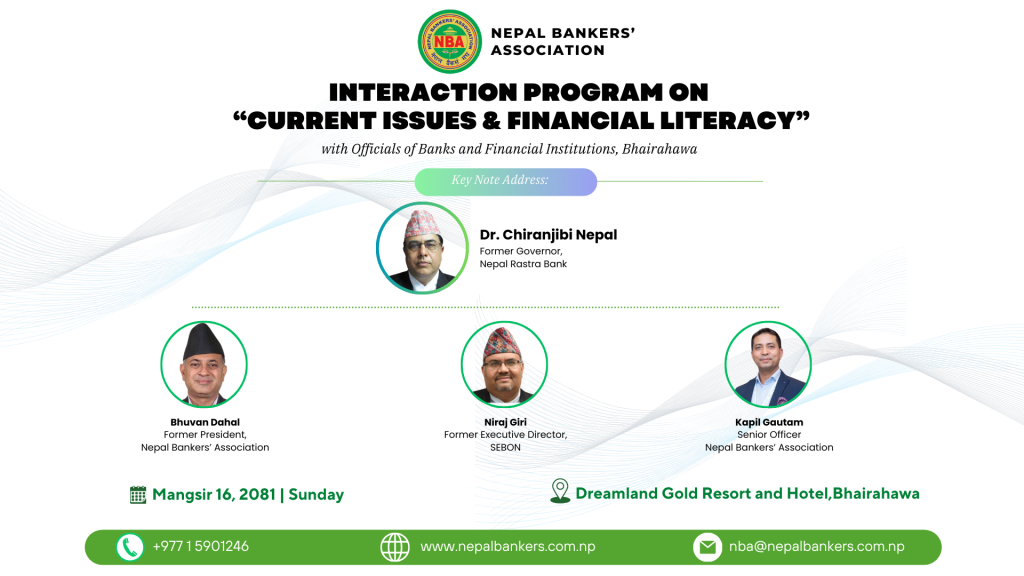

In his opening remarks, Mr. Ashim Nepal, Operations Officer at IFC, highlighted the objectives and underscored the significance of strengthening digital financial literacy and stressed the importance of improving accessibility and security of digital financial services. During the program, NBA Senior Officer, Mr. Kapil Gautam, delivered a presentation focusing on key digital payment products, digital lending, cross-border transactions, financial inclusion and consumer protection. Additionally, he highlighted the escalating risks of cyber fraud and emphasized the critical need for consumer education to enhance fraud prevention and safeguard users in the digital financial space.

During the program, Former Executive Director of the Securities Board of Nepal (SEBON), Mr. Niraj Giri, delivered an in-depth presentation on the securities market. He provided valuable insights into the legal framework that underpins the market and the practical factors influencing its operation. Beyond the regulatory aspects, he also delved into current market trends, effective investment strategies, and risk management techniques, offering a well-rounded perspective on navigating the securities market.

Former NBA President, Mr. Bhuvan Dahal delivered an engaging presentation on the pressing challenges facing the banking and financial sectors. He addressed critical topics, including the public’s perception of the industry and the factors contributing to rising negative sentiments. Drawing on data and evidence, Mr. Dahal deflated common myths and misconceptions, underscoring that Nepal’s banking sector remains stable, resilient, and well-regulated under the central bank’s policies. He concluded by highlighting the pivotal role of financial literacy, urging bank officials to prioritize this area in their financial literacy initiatives and customer interactions to build trust and awareness.

The Chief Guest of the program, Former Governor of Nepal Rastra Bank, Dr. Chiranjibi Nepal, shared his invaluable experiences and insights on addressing the policy-level challenges facing Nepal’s banking and financial sectors. Drawing from his extensive expertise, Dr. Nepal emphasized that the effectiveness of any policy lies not merely in its design but in its proper implementation. Furthermore, underscored the need for strong institutional capacity, accountability and commitment to translating policy objectives into tangible results.

In his closing remarks, Deputy Coordinator of NBA Lumbini Province Committee, Mr. Kush Sudan Singh, expressed his gratitude to all participants and resource persons for their valuable contributions to the program’s success. He emphasized the importance of conducting similar capacity-building initiatives repeatedly, highlighting their crucial role in enhancing the skills and knowledge of banking officials to address the evolving challenges in the financial sector effectively. The program witnessed active participation from over 45 officials representing various Commercial and Development Banks.