February 15, 2023 – Nepal Bankers’ Association (NBA) organized a media interaction program at NBA Office, Central Business Park, Kathmandu. The main goal of the program was to offer a forum for open discussion, share some banking industry data and respond to queries from media colleagues on relevant banking and financial issues.

Mr. Sunil KC, NBA President welcomed all the guests, set the context and highlighted the program objectives. During the discussion, he said that the Nepalese banking sector cannot exist independently beyond the global economic environment; and the interest rate rise is a result of both the internal and external economic environment. He also said that the present economic situation is complex and it does not seem possible to lower the interest rate to a single digit level as demanded by some. He expressed concern about rising number of negative remarks made about the banking industry and clarified that none of the stakeholders would benefit from this negative and misleading publicity. In addition, he requested everyone to work together and also underlined the importance of using reliable data and facts to communicate the message to the public through the media.

Mr. Gyanendra Pd. Dhungana, Immediate Past President said that even though some positive signs are seen in the current economic indicators, there may still be pressure on liquidity due to government’s calendar to raise internal debt in order to address the deficit. Comparing with international scenario, he also claimed that the current interest rate is not unusual. He also shared concern on growing NPL and said that the real effect of Covid is just beginning to be seen in the economy. He also emphases that the banks are still very much resilient and stable due to additional provision and capital strength.

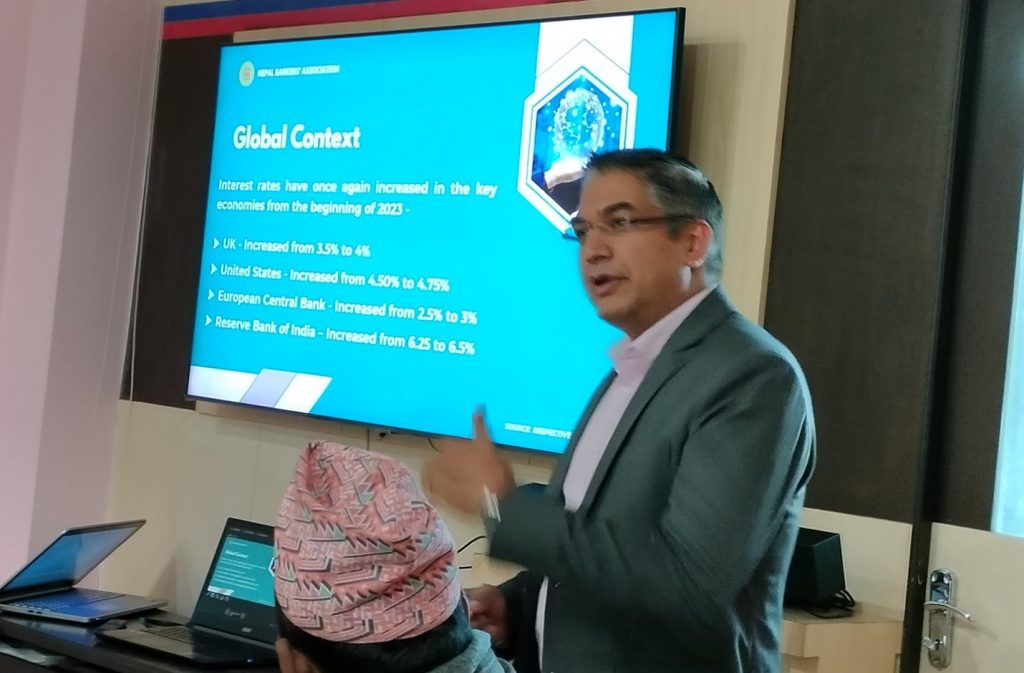

Mr. Anil Sharma, NBA Executive Director made a presentation where he highlighted global/national economic and banking context, reviewed the mid-term monetary policy and also pointed out the current challenges of the banking industry. He also discussed on the deposit and lending growth of the industry and the prospects ahead.

The program was actively participated by more than 40 journalists from different media.