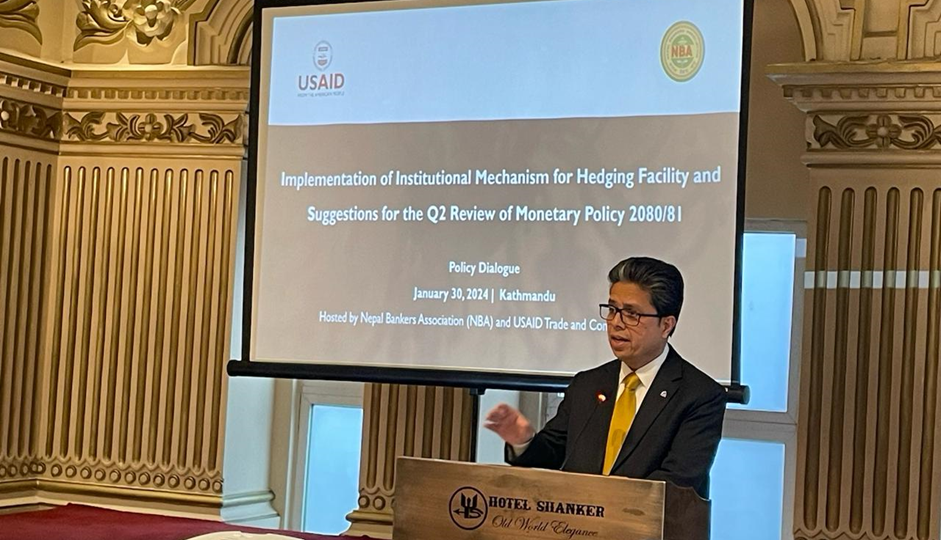

Nepal Bankers’ Association and USAID Trade and Competitiveness jointly organized a Policy Dialogue program on “Implementation of Institutional Mechanism for Hedging Facility and Suggestions for the Q2 Review of Monetary Policy 2080/81”. The main objective of the program was to discuss on some of the policy arrangements in the Monetary Policy 2080/81 and the various implementation aspects and concerning issues related to hedging.

Highlighting the purpose of the program, in his welcome speech NBA President, Mr. Sunil K.C highlighted the crucial role of Foreign Direct Investment to fulfill the goals of Nepal’s economic growth which in turn would support towards commitments Nepal has made to the international arena. He further said that in order to achieve the Sustainable Development Goals, Nepal needs huge investment and relying solely on domestic resources won’t be adequate and hence, it becomes vital for the Government to implement necessary measures.

During the program, Mr. Sishir Dhungana made a presentation where he pointed out that despite the initiation of the policy for the hedging facility and the Hedging Regulations, 2079 by the Government of Nepal, there are some challenges in implementation. Furthermore, he also highlighted how hedging facility can be made effective, what sort of role can be played by various stakeholders and who are the responsible bodies for policy implementation, procedures to be adopted to obtain hedging facilities and so on.

During the presentation, he also discussed and suggested some policy arrangements for half-yearly Monetary Policy review with special focus on Stressed Loan Resolution Framework, Banking Offence Amendment Bill, Working Capital Guidelines, investment in PEVC, Centralized KYC, among others.

Similarly, Joint Secretary of Ministry of Finance, Mr. Mahesh Acharya, said that the Government of Nepal is serious about hedging and is ready to make it effective by making necessary amendments in the Policy/Procedures.

Chief Guest of Program, Deputy Governor of Nepal Rastra Bank, Mr. Bam Bahadur Mishra said that the economic prosperity of the country is only possible if the morale and self-confidence of the industrialists, businessmen and banks is high, and Nepal Rastra Bank takes this into consideration while formulating policy guidelines. Throwing more light on the issue of hedging, he said that even now, banks are utilizing the facility of hedging in one way or another and the bank can leverage these facilities based on their individual capacity and technical efficiency.

At the end of the program, NBA Vice-President, Mr. Santosh Koirala concluded the program by expressing his gratitude to everyone for their presence and acknowledging the collective contribution made by all towards the success of the program.

The program was attended by the Executive Directors and officials from Nepal Rastra Bank, representatives of various concerned agencies, officials/representatives of various Associations, Chief Executive Officers and officials of commercial banks, among others.